Brief of the Institute

The Institute of Chartered Accountants of India (ICAI) is a statutory body established under the Chartered Accountants Act, 1949 (Act No. XXXVIII of 1949) for the regulation of the profession of chartered accountancy in India.

Since then Profession has grown leaps and bounds in terms of Membership

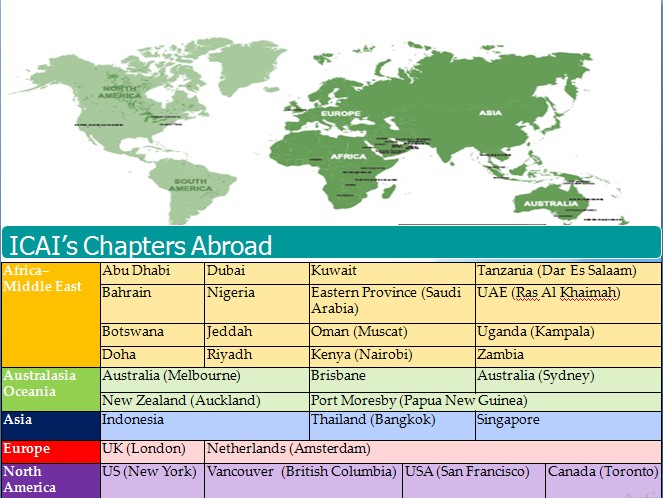

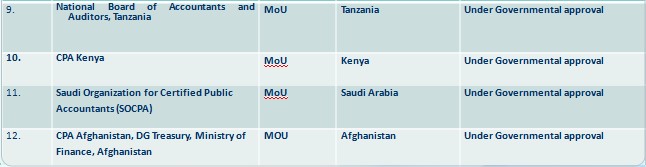

and Student base. During its more than fifty years of existence, the Institute has achieved recognition as a premier accounting body in the country for its contribution in the fields of education, professional development, maintenance of high accounting, auditing and ethical standards. The Institute has its Headquarters at New Delhi with 5 Regional Offices at Mumbai, Chennai, Kanpur, Kolkata, New Delhi and 163 branches spread all over the country. In addition, it has also set up 30 chapters outside India.

The total membership of the Institute is about 265K+ and around 8 Lakhs students are pursuing the Chartered Accountancy course. Out of the total members, nearly 70% are in Practice. Among the members in government, industry, banks, financial institutions, private enterprises etc. a significant number of members occupy eminent positions in their respective organisations such as Chairman of regulatory body, Chairmen of banks, Chairmen & Managing Directors of reputed enterprises, Executive Directors of innumerable enterprises/organisations. The members of the Institute are also considered to be very competent even in the foreign countries as is evident from the positions they are occupying in all major cities of the world.

Our Mission

The Indian Accountancy Profession will be the Valued Trustee of World Class Financial competencies, Good Governance and Competitiveness.

Profession in India

- 265K+ Members spread throughout the country and in different parts of the world

- Sizeable studentship base

- Increase in percentage of members joining industry

- Chartered Accountants are rendering services in every walk of economic life - Politics, Judiciary, Government, Agriculture, Corporate, NGOs

- Profession is dominated by small firms

- Increasing trends towards consolidation

- Government of India looks at ICAI as Partner in Nation Building

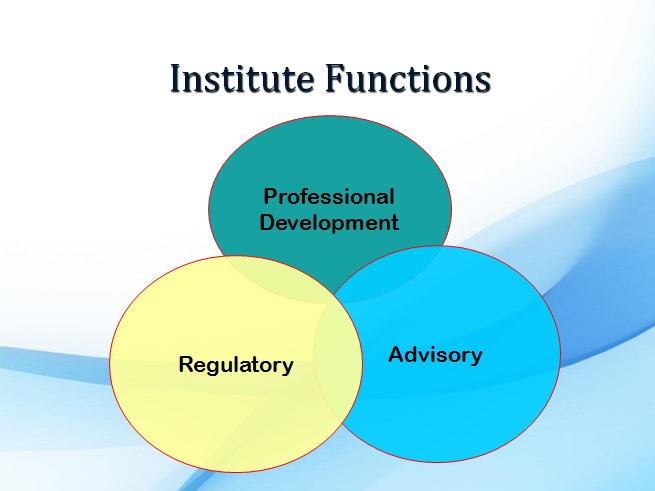

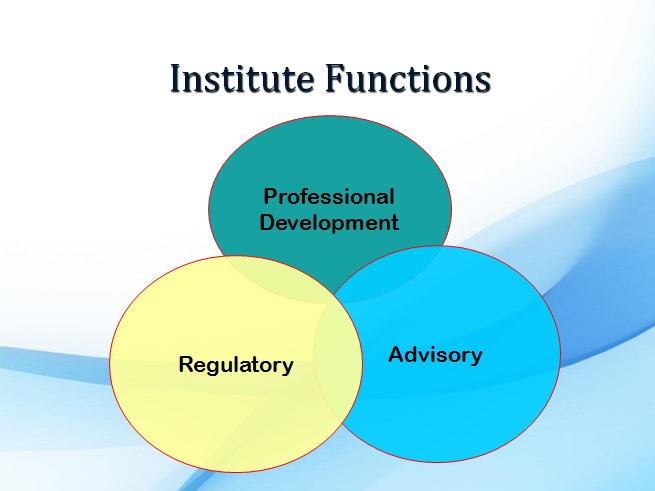

Role of ICAI

- To regulate the profession of Accountancy

- Education & Examination of Chartered Accountancy

- Exercise Disciplinary Jurisdiction

- Input on Policy matters to Government

- Ensuring Standards of performance of Members

- Formulation of Accounting Standards

- Prescription of Engagement and Quality Control Standards

- Laying down Ethical Standards

- Continuing Professional Education

- Financial Report Review

- Monitoring Quality through Peer Review

- Conducting Post Qualification Courses

- Focus on Capacity Building in the emerging context

ICAI Overseas

- ICAI has 30 chapters abroad out of which 8 chapters are based in Middle East region

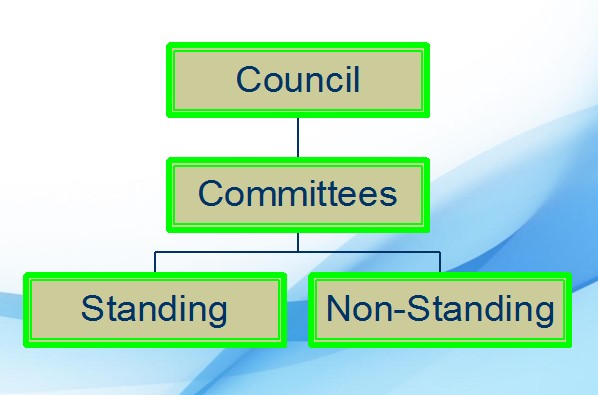

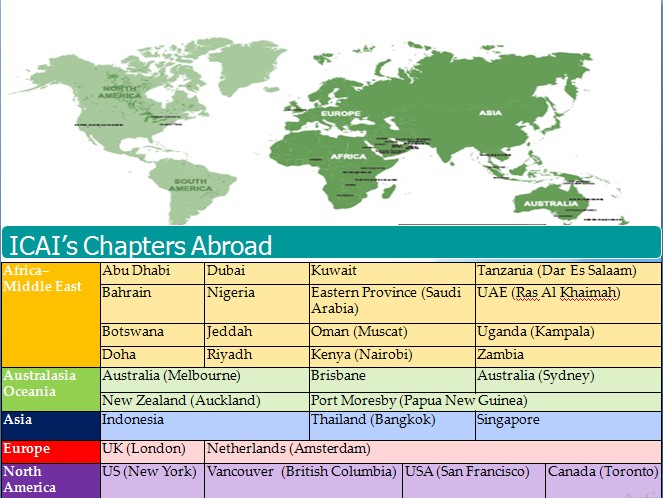

The Central Council

ICAI - A Key National Body

Offers inputs to

- Comptroller & Auditor General of India

- Ministry of Corporate Affairs, Govt. of India

- Reserve Bank of India

- Securities and Exchange Board of India

- Central Board of Direct Taxes

- Insurance Regulatory and Development Authority

- Departments of Central and State Governments

- Departments of Public Enterprises

Important Initiative Undertaken to Align with Changing Economic Order

- Convergence with International Standards of Accounting and Auditing

- Review and Revision of Education and training curriculum

- Launch of Post Qualification Courses Capacity building of firms

- Mandatory CPE Requirement

- Peer Review Mechanism

- Financial Report Review

- Brand building - Nationally and Internationally

- Focused approach on issues relating to Corp. Governance.

- Facilitating changes in regulatory frames.

- Vigorous pursuance of Mutual Recognition Agreements.

- Arrangement with Universities for graduation qualification to CA students

- Facilitating accounting reforms in various areas

Examples of Involvement of ICAI in National Organizations

- Drafting of Income Tax Laws

- Drafting of Competition Law

- Drafting of Company Law

- Capital Market - Development and Regulation

- Corporate Governance

- Accounting & Utilization of Governmental resources

- WTO & GATS

- GST

- Commercial and Economic Legislations

Education and Training

- Distant Mode of Education

- Education Through Accredited Institutions, Branches, e-lectures, video lectures and web casts.

- Comply with the requirements of international educational pronouncements of IFAC

- Comprehensive and contemporary theoretical and practical curriculum

- Continuous review and revision of the curriculum

Examination

- One of the largest Accounting examination networks

- Administrative conduct of examination and exam related process largely computerized

- Exams are held twice a year

- Examination system considered to be of high standard & integrity worldwide

- Has been lending expertise to accounting bodies in other countries

CPE

- ICAI has always been striving for excellence in terms of standards of professional services rendered by its members.

- In this age of information explosion and the rapid changes in technology, trade and industrial environment, the need for continual professional updation is supreme.

- To enable members to maintain the high standards of professional services, the CPEC is providing continued inputs to members by way of Seminars, Lectures, Background Material and use of the electronic media. This provides the sharpening of our professional skills so that the word 'Chartered Accountant' is synonymous with excellence in services. More than 7500 CPE Programs are held annually by CPE Organising Units.

- It ensures that the members remain continuously updated with respect to developments in existing and emerging disciplines and subject specific areas directly or indirectly related to the profession and to help impart necessary skills to the members so that knowledge thus garnered by them gets translated into practice.

- CPE requirements have been made mandatory for all the members of the ICAI, whether he/she be in practice or in service and such system is measured, monitored and managed scientifically.

Professional Ethics

Professional Development

- Identifying Role of Profession in emerging areas

- Developing Practice Areas

- Upgrading and updating the knowledge and skill sets

- Developing technical material to facilitate practice in new areas

- Considered as critical in the changed Scenario

Quality Control Initiative - Peer Review

- Peer Review Board of established in March 2002

- Focus on:

Compliance with Technical, Professional and Ethical Standards

Quality of Reporting

Systems and procedures for carrying out assurance services

Training programmes for staff (including articled and audit assistants) concerned with assurance functions, including availability of appropriate infrastructure

Compliance with directions and / or guidelines issued by the Council to the Members

Compliance with directions and / or guidelines issued by the Council relating to article assistants and / or audit assistants.

Quality Review Board

- Central Government has constituted Quality Review Board consisting of 11 persons.

- Council of ICAI has nominated 5 members on QRB

- Chairman and other 5 members have been appointed by Central Government

- As per the provisions of Sec. 28B of the CA Act, 1949 the Quality Review Board :-

a)Makes recommendations to the Council with regard to the quality of services provided by the members of the Institute;

b) Reviews the quality of services provided by the members of the Institute including audit services; and

c)Guides the members of the Institute to improve the quality of services and adherence to the various statutory and other regulatory requirements.

Financial Reporting Review Board

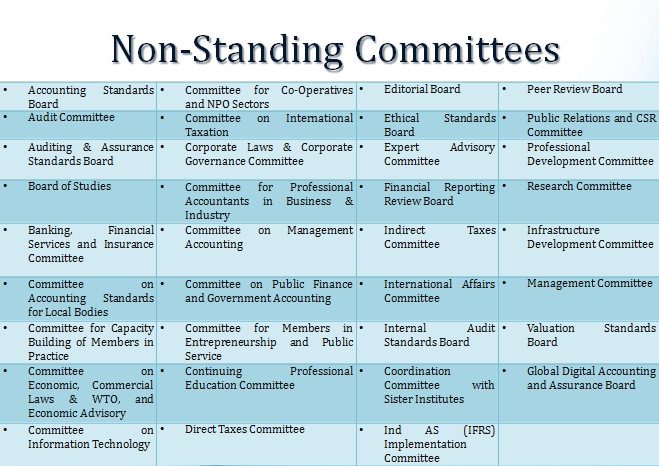

- The Financial Reporting Review Board was established in July 2002 as a non-standing Committee of the Council of the ICAI with a view to bring an overall improvement in the quality of services being rendered by the members of the profession.

- The Board reviews the general-purpose financial statements of certain enterprises with a view to determine, to the extent possible:

Compliance with the generally accepted accounting principles in the preparation and presentation of financial statements;

Compliance with the disclosure requirements prescribed by regulatory bodies, statutes and rules and regulations relevant to the enterprise; and

Compliance with the reporting obligations of the enterprise as well as the auditor.

- The FRRB may review the general purpose financial statements and the auditor's report of the following enterprises:

Enterprises selected either suo motto or

Enterprises referred to it by any regulatory body like, Reserve Bank of India, Securities and Exchange Board of India, Insurance Regulatory and Development Authority, Ministry of Company Affairs, etc or

Enterprises wherein serious accounting irregularities have been highlighted by the media reports.

- Action, if any, Non-Compliance observed: In case, the FRRB finds any non-compliance, it is classified in the following categories:

Non-compliance, not so material

Material Non-complaince

- In cases where non-compliances, not so material, are observed by the Board which do not affect the true and fair view of financial statements, the FRRB would appropriately bring the non-compliance to the attention of the auditor.

- In cases where material non-compliance are observed by the Board which affects the true and fair view of financial statements, it may :

- Action against the Auditor(s): refer the case to the Director (Discipline) of the Institute of Chartered Accountants of India for initiating action against the auditor under the Chartered Accountants Act, 1949.

- Action against the Enterprise: Insofar as the management of the enterprise is concerned, pending the grant of relevant powers to the FRRB by the Government of India, the FRRB would inform irregularity to the regulatory body relevant to the enterprise.

Enterprises within purview of FRRB

- Entities whose equity or debt securities are listed or are in the process of listing on any stock exchange, whether in India or outside India.

- Banks (including co-operative banks), financial institutions or entities carrying on insurance business.

- All commercial, industrial and business reporting entities, whose turnover (excluding other income) exceeds rupees fifty crore in the immediately preceding accounting year.

- Holding and subsidiary entities of any one of the above.

- Such other category of enterprises which in the opinion of the Board make the public interest vulnerable due to susceptibility to non-compliance of generally accepted accounting principles in the preparation and presentation of financial statements, non-compliance of the disclosure requirements prescribed by regulatory bodies, statutes and rules and regulations relevant to the enterprise and non-compliance of the reporting obligations of the enterprise and the auditor.

ROBUST DISCIPLINARY MECHANISM

- The Disciplinary Committee consists of 3 persons nominated by the Council and 2 nominated by Government of India.

- Presence of Government nominee is a must for all Disciplinary Committee proceedings.

- Strict action is taken against a member who is found to be guilty of professional misconduct with punishment getting tougher depending on the nature of misconduct including award of maximum penalty of Rs. 5 lakhs and also permanent removal in rare cases.

- From the year 2016-17, two benches of Disciplinary Committee have been constituted for expeditious disposal of pending cases.

- Amendments to the Chartered Accountants Act, 1949 & Rules framed thereunder relating to disciplinary mechanism are under consideration for removing procedural difficulties and enabling fast-track disposal.

International Presence

- ICAI is founder member of IFAC, CAPA SAFA and IIN.

- ICAI is represented in:

IFAC - As Board Member, Small and Medium Practices Committee (SMP Committee) and International Auditing and Assurance Standards Board (IAASB)

Chartered Accountants Worldwide (CAW)

CAPA - As Deputy Presidency; Chair, Public Sector Financial Management Committee and Member, PAO Development Committee

SAFA - As Board Member and member of various Committees & Working Groups (ICAI holds Permanent Secretariat, SAFA)

Asian Oceanian Standard Setters Group (AOSSG)- As member

International Innovation Network - As Member

Member, International Valuation Standards Council

- ICAI being consulted by IAASB in Audit Standards Setting and by IASB in IFRS setting

- Playing a lead role in the area of Developing Nations, SMPs and SMEs, International Public Sector Accounting Standards, International Education Standards

- ICAI plays an important role in the standard setting process of the National Standard-Setters and World Standard-Setters.

- Participate in the accountancy , corporate reporting, governance sustainability reporting and allied areas in the meetings organized by UNCTAD, OECD, GRI and various other multilateral forums.

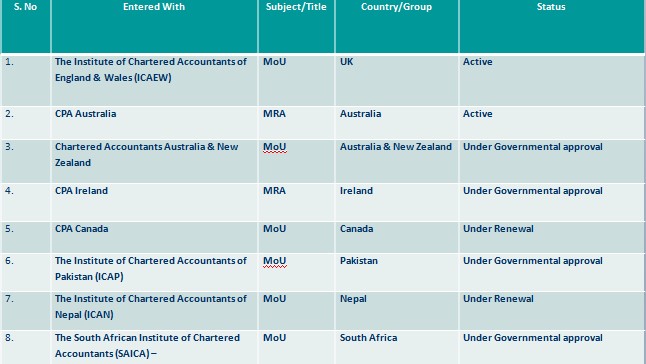

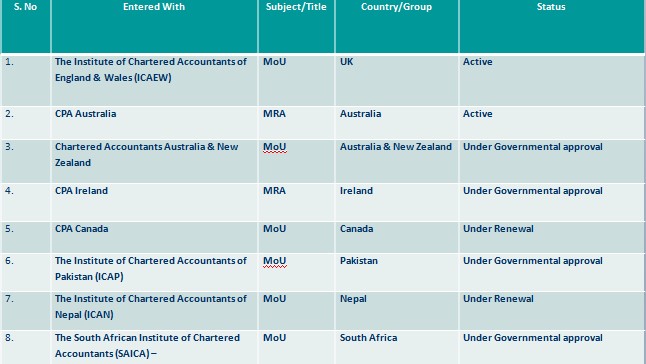

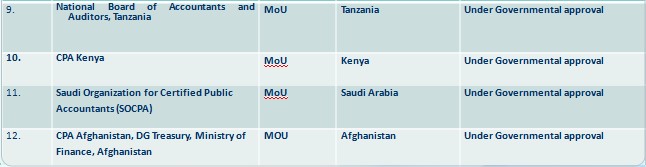

International Initiatives

- ICAI has signed MoUs with the following accounting Institutes world wide:-

MoU / MRA on anvil

ICAI - Towards Virtual Institute

Transformation journey

- ICAI will provide students, members, government, stakeholders with a centralized digital platform to improve and optimize the interactions with the Institute while ensuring high and improved turnaround in service times. ICAI will ensure complete visibility and accessibility to the information to the authorized end users ensuring its reliability and accuracy.

- ICAI will actively engage in building a reliable, available and secure infrastructure platform embracing Green computing principles across the value chain in its effort to reduce paper usage across its offices. ICAI will pioneer the adoption of Green Computing and set a benchmark across its peer Institutes in the world.

- ICAI will enable its employees across HO, RO and Branch offices to have visibility and access to the information with best of the breed user experience across all touch points. ICAI will actively pursue establishing a standard operating environment of its digital technology platform leveraging licensed software across all its offices thereby better optimizing the efficiencies of scale. ICAI will automate the processes and sub-process where possible to release time and energy of its employees from mundane / non-productive tasks into more productive tasks at the Institute.

- ICAI will aggressively pursue enablement of students and members, firms and other related entities in the emerging areas of accounting and auditing profession thereby ensuring timely availability of professional skill sets in the marketplace leading to better distribution of the opportunity pie across the members and students of ICAI.ICAI considers Information Technology (IT) as one of the key enablers in this transformation journey and will frame an IT Strategy and roadmap to realize the vision. ICAI looks forward to establishing a robust, secure, scalable, modular and reliable organizational IT infrastructure which can help realize the promise and vision of the Institute.